About Me

Kenrick is an incoming PhD researcher at the Institute of Statistics, Biostatistics, and Actuarial Sciences in Université catholique de Louvain under the supervision of Karim Barigou. His research focuses on integrating climate risks into mortality and financial risk modeling for life insurance. He aims to develop predictive models that incorporate climatic variables such as temperature, pollution, and precipitation, allowing for a better understanding of how these factors influence mortality trends and financial risks in life insurance. He also investigates how climate risks can impact the financial stability of insurers and explores the pricing of new financial products, such as catastrophe (CAT) bonds, which can help hedge against fluctuations in mortality.

Kenrick holds a master’s degree in applied mathematics with a major in mathematical finance from Ateneo de Manila University. His background includes quantitative risk management, stochastic modeling, and developing mathematical tools to address uncertainty in finance and insurance. He is particularly interested in applying machine learning techniques, such as neural networks, to mortality forecasting, insurance valuation, and hedging strategies.

Building on this foundation, he has become increasingly focused on the challenges posed by climate risks to the financial sector. Understanding and managing climate risks is becoming more important as environmental changes bring new and unpredictable challenges to financial security. Kenrick’s work aims to translate mathematical models into practical tools that help insurers prepare for climate risks, with the goal of contributing to a more resilient and equitable financial system.

Recent Research Paper

Risks, vol. 13, no. 2, 2025.

[Read here]

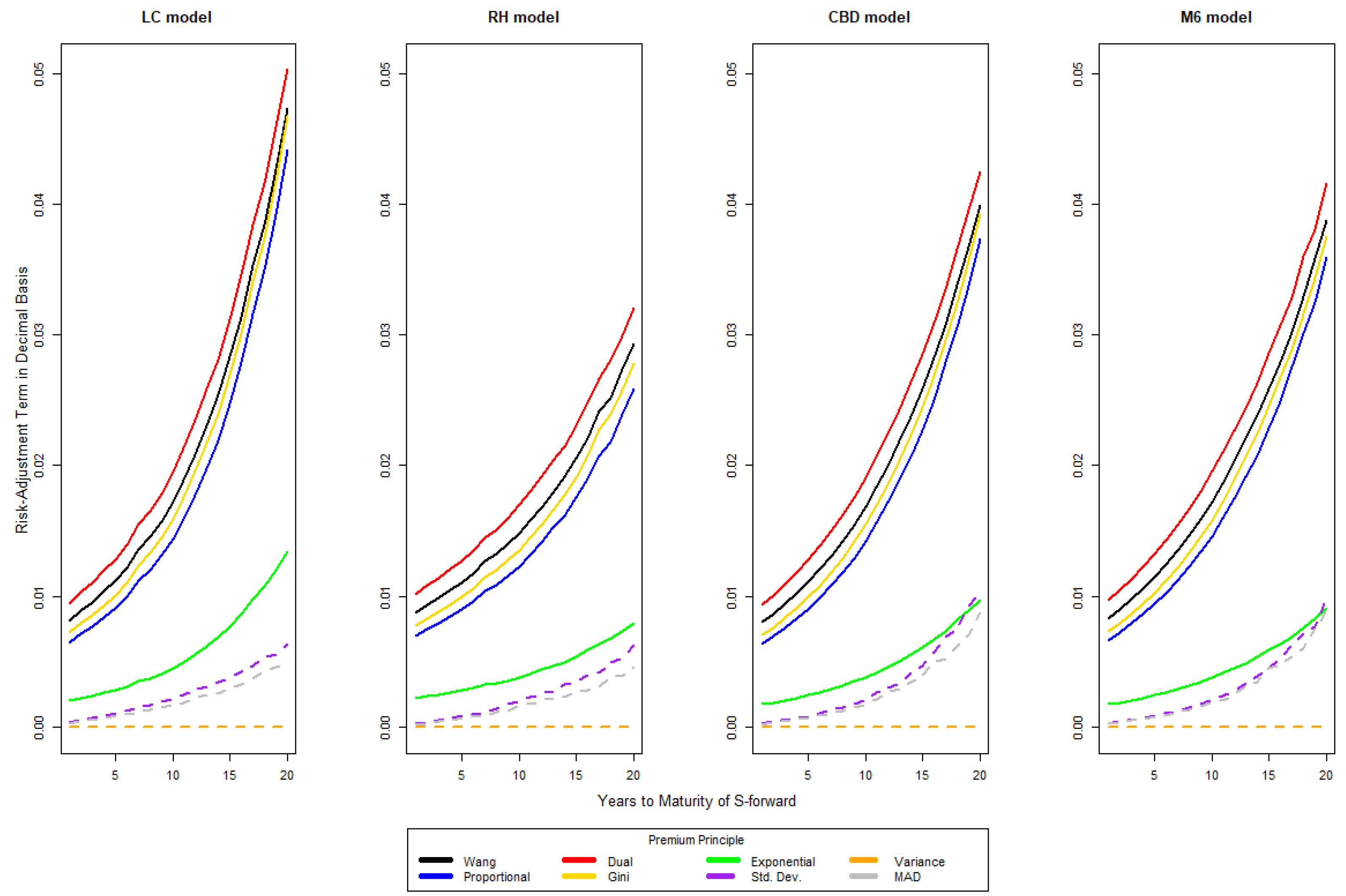

As life expectancy rises, pension plans face increasing longevity risk. Survivor contracts, a type of longevity-linked security, allow these plans to transfer risk to capital markets. However, there is still debate over the best mortality models and premium principles for pricing these contracts. This paper examines how different modeling choices affect the pricing and risk measurement of survivor contracts. We present a framework for evaluating risk using various mortality models and premium principles, and analyze their impact on key risk measures such as value-at-risk and expected shortfall. Our findings highlight the importance of refining both mortality models and premium principles to improve pricing accuracy and risk management. We also recommend that practitioners use expected shortfall alongside value-at-risk to better capture tail risks and guide capital allocation.